How To Pay Your Income Tax In Malaysia. Best Tax Saving Investments.

How To Step By Step Income Tax E Filing Guide Imoney

Tax Saving via NPS ELSS PPF MFs.

. Jul 25 2019 at 351 am. Web If you are a dual resident taxpayer and you claim treaty benefits as a resident of the other country you must timely file a return including extensions using Form 1040NR US. Guide To Using LHDN e-Filing To File Your Income Tax.

The income tax slabs and rates have been kept unchanged since financial year FY 2020-21. Introduction Individual Income Tax. Web Form EA is a Yearly Remuneration Statement prepared by the company to employees for tax submission.

Web How Does Monthly Tax Deduction Work In Malaysia. Change In Accounting Period. Web Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Web Foreign-Sourced Income for Malaysia Taxation. How To Pay Your Income Tax In Malaysia. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Tax Offences And Penalties In Malaysia. This page provides links to tax treaties between the United States and particular countries. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this.

According to Section 831A Income Tax Act 1967 that every employer shall for each year prepare and render to his employee statement of remuneration Form EA of that employee on or before the last day of February in the year immediately following the. Foreign-Sourced Income for Malaysia Taxation. Income Tax for NRI.

Headquarters of Inland Revenue Board Of Malaysia. The W-2 form also shows the amount withheld by the employer for federal income tax. Web Tax Saving - Know about how to income tax saving for FY 2022-23Best tax saving tips options available to individuals and HUFs in India are under Section 80C.

Web There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022-23 in Union Budget 2022. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. Employer Deadline 31st March of the following year.

How to File Income Tax Return Using Form 16. The chargeability of income is governed by. Web Therefore you should consult the tax authorities of the state from which you derive income to find out whether any state tax applies to any of your income.

Basis Period for Company. Web For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Some states of the United States do not honor the provisions of tax treaties.

Taxable income Tax. Guide To Using LHDN e-Filing To File Your Income Tax. Form E Employer Year End Tax Year-end This is used to report annual returns to the government for all employees.

Nonresident Alien Income Tax Return or Form 1040NR-EZ US. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA Skip to content. For FY 2021-22 and 2022-23 individual taxpayers will continue to choose between two tax regimes - the existing or old.

This must be submitted to the Inland Revenue Department by 31st March via the tax authority portal. Malaysia Information on Tax Identification Numbers Updated 2 December 2020 Section I TIN Description Malaysian Income Tax Number ITN or functional equivalent In Malaysia both individuals and entities who are registered taxpayers with the Inland Revenue Board. It is the gross salary less any contributions to pre-tax plans.

My support is about. A copy of the W-2 is sent to the Internal Revenue Service IRS. Web Is there a separate income tax form for non-resident instead of the standard PND 90.

Web Malaysia has the following income tax brackets based on assessment year. How To File Your Taxes Manually In. Web Amending the Income Tax Return Form.

Income Tax Return for Certain Nonresident Aliens With No Dependents and compute your tax as a nonresident. I have closed my tax file in Malaysia when I relocated to Thailand.

The Complete Income Tax Guide 2022

How To File Income Tax Return For Nri In A Few Simple Steps Ebizfiling

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To Step By Step Income Tax E Filing Guide Imoney

Malaysia Personal Income Tax Guide 2022 Ya 2021

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Guide 2021 Ya 2020

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Income Tax Rates Slab For Fy 2022 23 Or Ay 2023 24 Ebizfiling

Guide To Using Lhdn E Filing To File Your Income Tax

.png)

How To Check Your Income Tax Number

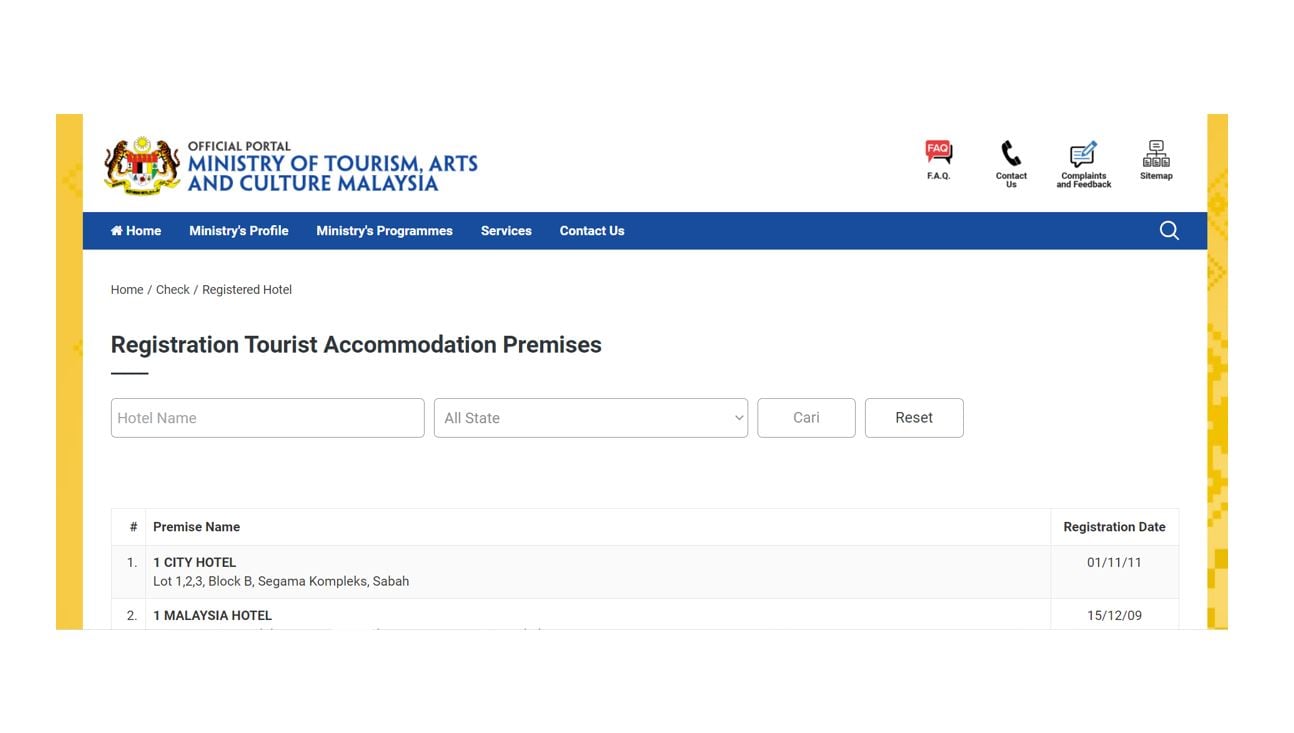

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

How To Step By Step Income Tax E Filing Guide Imoney

Guide To Using Lhdn E Filing To File Your Income Tax

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Malaysia Personal Income Tax Guide 2022 Ya 2021